It’s MONEY you can create in the privacy of YOUR OWN HOME!!

But would you SELL your home to someone who pays for it with a handful of invisible gigabits?

[PLEASE NOTE: You may assume that a bold emphasis within a blockquote is probably mine.]

SURE THING, KID! MAYBE IN FAIRY TALES, BUT WATCH OUT FOR REAL LIFE! ... And you know something I never liked about that “Beanstalk” story? Nobody ever even made the slightest effort to get their cow back! So tell me, whatever happened to your damned cow? (By the way, this New Yorker cartoon might NOT be in Public Domain. I need to check into that. / Cartoonist: Kaamran Hafeez)

“CRYPTOCURRENCY EXCHANGE FTX FILED FOR CHAPTER 11 BANKRUPTCY PROTECTION ON NOV. 11, 2022, AFTER A SWIFT FALL FROM GRACE”, WRITES INVESTOPEDIA. “THE COMPANY’S VALUATION PLUNGED FROM $32 BILLION TO BANKRUPTCY IN A MATTER OF DAYS, DRAGGING DOWN FOUNDER AND CEO SAM BANKMAN-FRIED’S $16 BILLION NET WORTH TO NEAR-ZERO.”

Oof!! I’m assuming he owned half the value of the company? That could be a problem for him, although it should only mean his wealth drops down to where the rest of us are.

Still, his customers will be okay, right? I mean, as long as their losses didn’t exceed $250,000, the limit the federal government insures each account in a bank?

No, wait!! I forgot! FTX isn’t a bank. It’s crypto!!

Cryptocurrency enthusiasts believe in decentralization and the reason they deal in this stuff is as a way of getting around not only banks but also governments! For some reason, crypto fans prefer doing business directly one-to-one with somebody, “without the need for a trusted third party”.

And they also like crypto because it’s more secure! The word “crypto” means “secret” and is sort of short for “cryptography”, the art of writing and reading “secret codes” — like the Enigma machine used by the Nazis to communicate in World War II — but just like those guys, Crypto-bros also see their system as virtually un-hackable.

Which, by the way, reminds me of what happened directly after FTX’s bankruptcy filing:

Within hours of filing for bankruptcy, FTX said it was the victim of “unauthorized transactions” and that it would move its digital assets to cold storage for security purposes. Outside analysts said they suspect that about $477 million was stolen from FTX in the suspected hack.

But lest we get too ahead of ourselves and get led into thinking the system obviously isn’t as un-hackable as its supporters claim? Remember, this could have been an inside job of some kind, perpetrated by somebody with some inside knowledge.

(So do you feel any better about crypto now?)

Some say crypto is in the midst of what they’re calling a “crypto winter” right now, and I don’t mean to pick on them when they’re down, but all this aims a spotlight on this whole new way we’ll all be doing money transactions from now on — replacing money, I reckon?

Or is that even what crypto is supposed to be doing?

That’s what I’d been meaning to look into for a long time, and this was the week I got around to it.

(Did I succeed? Not sure. After all that reading, I’m still not certain I fully get this stuff.)

I will now make a fool out of myself by trying to tell you what cryptocurrency is all about.

(No, you don’t really have to bear with me on this if you don’t want to. You can just cut out now and go do something much less annoying while you still have the chance.)

SOME HISTORY

Here’s what I myself think happened to bring this all about:

As far as I can tell, it started back in 2009 as a response to the Great Recession, which started because Wall Street was running short on ideas for products to sell to very rich people in search for non-regulated investments, and what they came up with was this weird idea of slicing-and-dicing both good and bad mortgages, then combining them together into a bundle they could sell cheaply to customers who had no idea that it would explode in their very hands once they got it home.

It was failure on the part of real estate brokers who started fooling people who couldn’t afford a home into even applying for a mortgage, and it was a failure of investment bankers to start approving the applications, knowing they were just going to be passing the problem on the someone else, and it was a failure of government whose job it was head this sort of thing off before it brought down the economy.

So the takeaway for some mythical, maybe-even-non-existent, person known as Satoshi Nakamoto was that we’d all be better off from now on if we stopped trusting banks and government to oversee our financial transactions, and turn to his alternative.

What [he/she/they/it] came up with was this, a nine-page white paper that Satoshi circulated, calling it, “Bitcoin: A Peer-to-Peer Electronic Cash System”:

A purely peer-to-peer version of electronic cash would allow online payments to be sent directly from one party to another without going through a financial institution. Digital signatures provide part of the solution, but the main benefits are lost if a trusted third party is still required to prevent double-spending.

Okay, wait. How’d that “double-spending” problem get in there? Here what that is, from Wikipedia:

Double-spending is a potential flaw in a digital cash protocol in which the same single digital token can be spent more than once.

Unlike physical cash, a digital token consists of a digital file that can be duplicated or falsified. As with counterfeit money, such double-spending leads to inflation by creating a new amount of copied currency that did not previously exist.

So let’s go back to Satoshi’s letter, this time with jargon bolded:

We propose a solution to the double-spending problem using a peer-to-peer network. The network timestamps transactions by hashing them into an ongoing chain of hash-based proof-of-work, forming a record that cannot be changed without redoing the proof-of-work. The longest chain not only serves as proof of the sequence of events witnessed, but proof that it came from the largest pool of CPU power. As long as a majority of CPU power is controlled by nodes that are not cooperating to attack the network, they'll generate the longest chain and outpace attackers.

Yeah, right? Technobabble!! To add to the fun, this coin thing comes with a whole new jargon you’ll need to know to use it!

Is it some kind of secret code? Yes, but at least it’s coming from someone who actually knows what he’s talking about instead of your daughter’s fast-talking boyfriend who might only be trying to snow you.

Essentially what I think he’s saying, although I might be wrong, is that, in his system, double-spending one given coin has a better chance of not happening if you filter it through a large group of “miners”, or “nodes”, each with loads of “CPU power” (that’s, well-intentioned people, working on computers, each having lots of processing power), checking the “proof-of-work” (solving math puzzles which guess the code needed to verify that someone put some effort into this), then “timestamping” it (putting a digital signature on it?) by “hashing” it (using Bitcoin’s algorithm to generate a random number guess?) to, if successful, add onto a “blockchain” (an ongoing ledger of transactions, maintained by the whole network of computers) — instead of just having it looked over by a few tellers at a bank who I’m guessing he thinks may not be sufficiently trustable.

And, by the way, all that whatever-it-is that these miners mined can be kept in a “wallet” (“Crypto wallets store your private keys, keeping your crypto safe and accessible. They also allow you to send, receive, and spend cryptocurrencies...”) — which can be either a “hot wallet” (on-line accessible storage) or a “cold wallet” (off-line storage, and I think not even connected to online).

In short, not meaning to beat to death a dead horse, this proposed “Bitcoin”, which soon became I guess the first and most successful cryptocurrency in the world (so far), should be popular with people who trust neither banks nor governments.

YEAH, YEAH, YEAH ... BUT WHAT’S ITS POINT??

HI-HO! HI-HO! IT’S OFF WE GO TO ... OK, TELL US AGAIN: WHAT ARE WE MINING FOR? ... (Walt Disney Productions trailer / Animator: Shamus Culhane via Wikipedia / Public Domain)

For example, cryptocurrency says it has no middleman, but what do they call all those miners, doing all that busy-work, encoding and decoding my purchases or whatever? Aren’t they middlemen?

Going out on a limb here, but I’m guessing these “miners”, with their “proof-of-work” tasks, might harken back to John Maynard Keynes’s famous solution to the unemployment problem:

If the Treasury were to fill old bottles with banknotes, bury them at suitable depths in disused coalmines which are then filled up to the surface with town rubbish, and leave it to private enterprise on well-tried principles of laissez-faire to dig the notes up again (the right to do so being obtained, of course, by tendering for leases of the note-bearing territory), there need be no more unemployment and, with the help of the repercussions, the real income of the community, and its capital wealth also, would probably become a good deal greater than it actually is.

It would, indeed, be more sensible to build houses and the like; but if there are political and practical difficulties in the way of this, the above would be better than nothing.

Of course, you could just give those people the money, rather than making them dig it out of the town garbage, but I guess that would make it too easy! When somebody puts the sweat equity and time into doing something that not everyone would choose to do, the theory is that the work gains value.

Or maybe, of course, it just appears to, only because enough people want it to. Mass hypnosis? A mirage? Emperor’s new duds?

And that, I think, is what’s behind Bitcoin’s “proof-of-work” requirement. Some miner “works hard” to “dig this up”, so they earn a reward.

But work may be the wrong word for this. As described below on Investopedia, it seems to be more like thousands of shoemaking-elves, only this time, sitting at thousands of tables playing blackjack:

What is the bitcoin mining math puzzle?

At the heart of bitcoin mining is a math puzzle that miners are supposed to solve in order to earn bitcoin rewards. ... Though it is often referred to as complex, the mining puzzle is actually fairly simple and can be described as guesswork.

The miners in Bitcoin's network try to come up with a 64-digit hexadecimal number [that is, base 16 rather than base 10], called a hash, that is less than or equal to a target hash in SHA256, Bitcoin's PoW [“proof-of-work”] algorithm.

A miner's systems use considerable brute force in the form of multiple processing units stacked together ... guessing all possible 64-digit combinations until they arrive at a solution. The systems that guess a number less than or equal to the hash are rewarded with bitcoin.

Here's an example to explain the process. Say you ask friends to guess a number between 1 and 100 that you have thought of and written down on a piece of paper. Your friends don’t have to guess the exact number; they just have to be the first person to guess a number less than or equal to your number.

If you are thinking of the number 19 and a friend comes up with 21, they lose because 21 is greater than 19.

But if someone guesses 16 and another friend guesses 18, then the latter wins because 18 is closer to 19 than 16.

In very simple terms, the bitcoin mining math puzzle is the same situation described above except with 64-digit hexadecimal numbers and thousands of computing systems.

The image of these miners mining also reminds me of that famous “infinite monkey theorem”:

The infinite monkey theorem states that a monkey hitting keys at random on a typewriter keyboard for an infinite amount of time will almost surely type any given text, such as the complete works of William Shakespeare.

Maybe what I’m picturing now is an infinite number of monkeys sitting at blackjack tables, but competing against each other rather than just the dealer.

But in our case, the Bitcoin’s inventor(s) set a cap of only 21,000,000 Bitcoins that can be ever mined, which they have estimated won’t be achieved until the year 2140 CE. (That’s from a video, “Bitcoin Mining”, found here.)

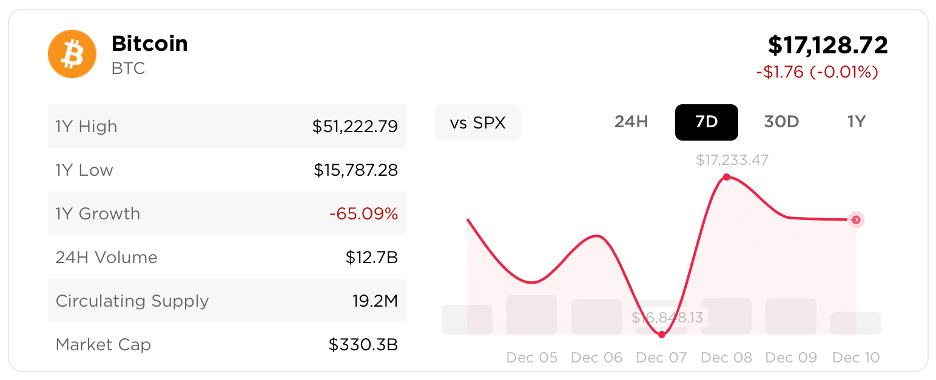

By the way, as of December 11th of 2022, according to a chart on nerdwallet.com (above), there were only 19.2-million bitcoin in circulation, worth a total of $330.3 billion, and on that day, you could have bought one of them for $17,128.72 — the value of which, as you see, was down about 65% for the year! The year’s high was $51,222.79.

True, I suppose if you’re desperate to buy, now might be the time, but maybe if you think about it some more, you’d come to your senses.

BESIDES THAT, MAYBE EVEN CALLING THIS CRYPTOCURRENCY CURRENCY IS MISLEADING. THIS IS FROM WIKIPEDIA:

It is a decentralized system for verifying that the parties to a transaction have the money they claim to have, eliminating the need for traditional intermediaries, such as banks, when funds are being transferred between two entities.

So I suppose it’s a replacement for a bank transfer of funds to somebody else’s account, like maybe Zelle, which performs transfers in an association of banks? Although with Zelle, there’s no need to convert it into funny money first.

Or maybe it’s Venmo, which is owned by PayPal, although Venmo itself actually also offers and accepts the major cryptos already, alongside “fiat money” (which is another term for what the rest of us call “money”.)

So maybe it replaces your Mastercard or Visa, or maybe it’s like migrant workers sending money back home via Western Union?

Some say the best way to make purchases with bitcoin is to use a “crypto debit card”, which is like a gift-card, only it’s preloaded with crypto instead of real money — although when you use it, the retailer gets the real money, which seems to beg the question of what the crypto brings to this arrangement.

Clearly, that question could be asked of all these cards and services that crypto could replace. Other than adding more complication and volatility, how is spending with bitcoin different than using regular money?

AND IF CRYPTO IS A “CURRENCY”, IS IT REALLY EVEN LEGAL? GOOD QUESTION!

In the United States, you might think there would be laws against treating this crypto stuff like “money”, something you’d think federal governments are supposed to have a monopoly on ... and you might be (sort of) right.

Although the Constitution says states can’t issue their own currency, apparently nowhere in the document does it say you can’t issue your own! (Of course, it also does not say anybody has to accept yours as payment, which it does say about the money it issues itself.)

But according to findlaw.com, there is, in addition to what’s in the Constitution, a federal statute prohibiting the minting and passing of coins, and maybe even more than just those:

Under 18 U.S. § 486, it's a criminal offense to make or pass any metal coins "intended for use as current money, whether in the resemblance of coins of the United States or of foreign countries, or of original design."

An offense is punishable with up to 5 years in prison, a fine, or both.

This prohibition arguably applies to paper money as well. Article 1, section 8, clause 5 of the U.S. Constitution gives Congress the power to coin money and regulate its value. The Justice Department believes this gives the federal government the "concurrent power to restrain the circulation of [private] money."

If true, it is arguably illegal for you to make your own currency and set it free upon the world.

As Stephanie Rabiner, Esq. at Findlaw also said back in 2012, there have been local communities that have been known to get away with issuing their own money:

A number of cities across the country have founded their own private currencies [click link to see which cities] ... The goal is to keep money in the community and encourage local spending. ...

But is it legal? Can you make your own currency?

If it's a joke amongst friends, you're probably fine. But if you plan to circulate the private currency, you might want to give it a second thought. ...

As for why these cities have been allowed to circulate private currency, it might have something to do with their local nature. Plus, many of them function as scrip, vouchers and large systems of barter — they're not actual currencies.

Of course, those laws are about coins and paper, not invisible, so who knows! .

Maybe this is why Crypto folks don’t try that hard to be recognized too soon as “currency”. Maybe they don’t want the IRS on them, for example, to be paying income tax if you’re paid in this stuff.

But when, as a virtual currency, it’s not a currency, then it’s sometimes regulated by the government as one of these:

United States virtual currency law is financial regulation as applied to transactions in virtual currency in the U.S. The Commodity Futures Trading Commission has regulated and may continue to regulate virtual currencies as commodities.

The Securities and Exchange Commission also requires registration of any virtual currency traded in the U.S. if it is classified as a security and of any trading platform that meets its definition of an exchange.

And, by the way, the creators of crypto tend to see themselves as “exchanges”, so there is that to consider.

While many countries ban the use of cryptocurrencies, the following countries ban them outright:

According to the U.S. Library of Congress, as of November 2021, a total of nine countries have banned cryptocurrency completely. These countries are Algeria, Bangladesh, China, Egypt, Iraq, Morocco, Nepal, Qatar and Tunisia. Another 42 countries have an implicit ban on the asset, generally by the means of not allowing financial institutions in the given country to take on crypto companies as clients.

El Salvador, on the other hand, has gone all in. Here’s how it’s going:

In September 2021, El Salvador became the first country to make bitcoin legal tender, requiring all businesses to accept the cryptocurrency. In an attempt to popularize and regularize its use, the government gave citizens financial incentives to download a special cryptocurrency app.

Half the nation’s households downloaded the app when the bitcoin law went into effect. Since the start of 2022, however, very few households have joined the early movers.

Among early downloaders, more than 60 percent have not made a transaction after spending the free bitcoin that came with the account, and 20 percent have yet to spend the bonus.

Seven of those nine countries mentioned above who have outright banned crypto are majority Islamic, so might there be a religious connection there?

The question Muslims want answered is, “Is cryptocurrency halal?” — that is, acceptable under the Koran. If not, it’s “haram”. These excerpts are part of a discussion on the website of Sarwa, an investing company based in Dubai and Abu Dhabi:

No, this argument goes, it’s not halal! it’s haram (which is not okay):

Mufti Taqi Usmani, a former judge of the supreme court of Pakistan, is representative of this side of the debate.

“In Shariah, there is no valid reason to accept bitcoin or other cryptocurrencies as a currency. It is just an imaginary number, which is generated through a complex mathematical process. It is purchased for gambling or speculations, and used in illegal or unlawful transactions”.

Yes, the other side argues, crypto is halal (which is okay):

The Islamic Economic Forum, a Whatsapp-based group of Islamic economists and jurists, argues that “a cryptocurrency is permissible as long as it doesn’t breach Islamic prohibitions on interest, contractual uncertainty, and gambling ...

CRIMINAL ACTIVITY

Just for context:

When I was young and tiny, I kind of remember the famous “Great Brinks Robbery” was huge news, which netted (I only just now learned by googling it) what was then considered a whopping $2.775 million! (That would be worth about $35.437 million today.)

Hey! Welcome back to 2022! Hope you enjoyed the digression!

In addition to the aforementioned FTX hack, you might (or might not) remember some of these incidents in the news:

In February 2014, the world's largest Bitcoin exchange, Mt. Gox, declared bankruptcy. Likely due to theft, the company claimed that it had lost nearly 750,000 Bitcoins belonging to their clients. This added up to approximately 7% of all Bitcoins in existence, worth a total of $473 million.

Mt. Gox blamed hackers, who had exploited the transaction malleability problems in the network. The price of a Bitcoin fell from a high of about $1,160 in December to under $400 in February.

On 21 November 2017, Tether announced that it had been hacked, losing $31 million in USDT from its core treasury wallet.

On 7 December 2017, Slovenian cryptocurrency exchange Nicehash reported that hackers had stolen over $70M using a hijacked company computer.

In May 2018, Bitcoin Gold had its transactions hijacked and abused by unknown hackers. Exchanges lost an estimated $18m and Bitcoin Gold was delisted from Bittrex after it refused to pay its share of the damages.

In January 2018, Japanese exchange Coincheck reported that hackers had stolen $530M worth of cryptocurrencies.

In June 2018, South Korean exchange Coinrail was hacked, losing over $37M worth of cryptos. The hack worsened an already ongoing cryptocurrency selloff by an additional $42 billion.

On 9 July 2018, the exchange Bancor, whose code and fundraising had been subjects of controversy, had $23.5 million in cryptocurrency stolen.

A 2020 EU report found that users had lost crypto-assets worth hundreds of millions of US dollars in security breaches at exchanges and storage providers. Between 2011 and 2019, reported breaches ranged from four to twelve a year. In 2019, more than a billion dollars worth of crypto assets was reported stolen. Stolen assets "typically find their way to illegal markets and are used to fund further criminal activity".

In December 2021, Monkey Kingdom - a NFT project based in Hong Kong lost US$1.3 million worth of cryptocurrencies via a phishing link used by the hacker.

Also noteworthy:

According to a 2020 report produced by the United States Attorney General's Cyber-Digital Task Force, the following three categories make up the majority of illicit cryptocurrency uses: "(1) financial transactions associated with the commission of crimes; (2) money laundering and the shielding of legitimate activity from tax, reporting, or other legal requirements; or (3) crimes, such as theft, directly implicating the cryptocurrency marketplace itself." The report concludes that "for cryptocurrency to realize its truly transformative potential, it is imperative that these risks be addressed" and that "the government has legal and regulatory tools available at its disposal to confront the threats posed by cryptocurrency's illicit uses".

According to the UK 2020 national risk assessment—a comprehensive assessment of money laundering and terrorist financing risk in the UK—the risk of using crypto assets such as Bitcoin for money laundering and terrorism financing is assessed as "medium" (from "low" in the previous 2017 report).

Legal scholars suggested that the money laundering opportunities may be more perceived than real. Blockchain analysis company Chainalysis concluded that illicit activities like cybercrime, money laundering and terrorism financing made up only 0.15% of all crypto transactions conducted in 2021, representing a total of $14 billion.

So is this sort of thing inevitable? This is what Matt Levine said in Bloomberg:

When ragtag groups of hackers with no business plan can raise millions of dollars from anyone with an internet connection, they all will. The odds that any particular one of those non-business-plans will succeed are low. The odds that any particular one will be a scam are high.

Another good insight from Matt:

The practical problem with censorship resistance is that the crypto world touches the real world at various points, and those contacts make it hard to be totally free from the pressures of outside influence.

A meme in crypto is the “$5 wrench attack,” named for an xkcd web cartoon pointing out that the way to steal someone’s cryptocurrency isn’t by using sophisticated methods to hack his laptop but rather by “hitting him with this $5 wrench until he tells us the password.”

What to do? How about just don’t even start?

(And by the way, for the best explanation of all this crud I could find for my article? if you want a deep-dive, I highly recommend Matt’s (admittedly long) article at Bloomberg, titled, “The Only Crypto Story You Need”. I think it’s comprehensive and also, very nicely writ!)

MUCKING WITH THE ENVIRONMENT

What’s the electricity cost to mine one Bitcoin in the U.S.?

During the summer, with the average price of electricity at 21 cents per kWh, it was averaging about $21,089, which is about $4-thousand more than they sell for. (In Kuwait, with electricity averaging three cents per kWh, you would pay only $1,393.95.)

How does this impact the environment? It kills it:

Mining for proof-of-work cryptocurrencies requires enormous amounts of electricity and consequently comes with a large carbon footprint due to causing greenhouse gas emissions.

Proof-of-work blockchains such as Bitcoin, Ethereum, Litecoin, and Monero were estimated to have added between 3 million and 15 million tonnes of carbon dioxide (CO2) to the atmosphere in the period from 1 January 2016 to 30 June 2017.

By November 2018, Bitcoin was estimated to have an annual energy consumption of 45.8TWh, generating 22.0 to 22.9 million tonnes of CO2, rivalling nations like Jordan and Sri Lanka.

By the end of 2021, Bitcoin was estimated to produce 65.4 million tonnes of CO2, as much as Greece, and consume between 91 and 177 terawatt-hours annually.

By the way, how’s the world doing on meeting the goals of the Paris Agreement?

UN Climate Change News, 26 October 2022 – A new report from UN Climate Change shows countries are bending the curve of global greenhouse gas emissions downward but underlines that these efforts remain insufficient to limit global temperature rise to 1.5 degrees Celsius by the end of the century.

According to the report, the combined climate pledges of 193 Parties under the Paris Agreement could put the world on track for around 2.5 degrees Celsius of warming by the end of the century.

I, for one, can think of something we could consider making illegal in hopes of better meeting those goals.

BY THE WAY, HOW IS CRYPTO AS JUST AN INVESTMENT?

No way to value in cryptocurrencies

One of the major critiques of cryptocurrencies as investments is that they have no intrinsic value, because they don’t produce anything for their owners. Your return is entirely dependent upon selling it to someone else for a higher price. ...

“Crypto is an investment in nothing,” [legendary investor Charlie] Munger told the Australian Financial Review in an interview in July. “I don’t want to buy a piece of nothing, even if somebody tells me they can’t make more of it.”

HOW ABOUT CRYPTO AS A PLACE TO HIDE, IN TIMES OF TROUBLE?

“I’m not sure crypto can be considered a safe haven given its volatility,” says Scott Sheridan, CEO of online brokerage firm tastyworks. Popular cryptocurrencies such as Bitcoin and Ethereum have fallen nearly 70 percent from their all-time highs as investors shunned risk assets following the rise in interest rates.

HERE’S THE OPINION OF SOMEONE WHO “CALLED” THE DOTCOM BUBBLE:

Cryptocurrencies have been compared to Ponzi schemes, pyramid schemes and economic bubbles, such as housing market bubbles.

Howard Marks of Oaktree Capital Management stated in 2017 that digital currencies were "nothing but an unfounded fad (or perhaps even a pyramid scheme), based on a willingness to ascribe value to something that has little or none beyond what people will pay for it", and compared them to the tulip mania (1637), South Sea Bubble (1720), and dot-com bubble(1999), which all experienced profound price booms and busts.

IN THE NY TIMES, ECONOMIST PAUL KRUGMAN DISSES EVEN BLOCKCHAIN’S REASON TO EXIST:

The original rationale for Bitcoin was that it would do away with the need for trust — you wouldn’t have to worry about banks making off with your money, or governments inflating away its value. In reality, however, banks rarely steal their customers’ assets, while crypto institutions more easily succumb to the temptation, and extreme inflation that destroys money’s value generally happens only amid political chaos.

YIPES! I ALMOST FORGOT ABOUT THOSE “NON-FUNGIBLE TOKEN” THINGS (AKA, “NFTs”)!!

For starters, Melania Trump is now selling them:

The former first lady announced Thursday that she is selling an NFT, or a non-fungible token, titled “Melania’s Vision” ...

A portion of the proceeds will “assist children aging out of the foster care system by way of economic empowerment and with expanded access to resources needed to excel in the fields of computer science and technology,” according to a press release from Trump’s office. ...

The NFT is a “watercolor” by Marc-Antoine Coulon that includes an audio recording of Trump, according to a press release from her office. The former first lady’s digital art will cost approximately $150 and will be available to purchase between December 16 and December 31, 2021.

And exactly what are NFTs?

Non-fungible tokens (NFTs) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other.

Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency. This differs from fungible tokens like cryptocurrencies, which are identical to each other and, therefore, can serve as a medium for commercial transactions.

In other words, they are digitized, just like cryptocurrency, except that a Bitcoin is a Bitcoin and they are all the same, while each NFT is an individual creation that can’t be copied.

They’ve been very popular. There are apparently cartoons of a whole bunch of bored apes that people collect. I can’t quite grasp what there is in some picture to “collect”, and what you do with them, yet somebody did actually “steal” some last December.

BUT HERE’S THE THING ...

WHILE I’VE TRIED TO KEEP THIS EXPLANATION RIDICULOUSLY SIMPLE, I SUSPECT I’VE BEEN FAILING TO HELP YOU UNDERSTAND HOW THIS STUFF WORKS,

... and if you agree with me on that, you may be getting my point, which is that it doesn’t make an awful lot of real sense.

My main question is, what the hell is it that crypto is intended to replace?

Is crypto really supposed to be a currency — for example, to replace “fiat” money? If so, I don’t think it makes a very good one.

Is it really worth all the complexity, with several thousands of “miners” sitting around competing to be the first to solve a math puzzle, just so you can buy that latte and Danish at Starbucks?

If so, I think there are better ways not only to do small purchases, but also large ones.

Is it supposed to be faster? (It’s apparently slower.) Easier? (It’s pretty complicated.) Safer? (It’s become the tool-of-choice for criminals.)

You know what crypto seems to be good at? A way for suckers to try to buy a digital doodad low and sell it high to some other sucker who also wants to buy low and sell high to some other sucker who also wants to buy low and sell high to some other sucker who also wants to …

When you see a frenzy of buying and selling and can’t see any product, you know you’re looking at a speculative bubble, and the trouble with a bubble is, at some point, we run out of suckers and run out of highs, and that’s when the bubble pops and everyone starts looking back and forth and asking about what just happened.

But blockchain is not just a Ponzi scheme, it’s one that’s destroying the planet, and because of that, we not only need to stop doing it ourselves, we, the people of the world, need to outlaw it.

YEAH, OKAY, CHIMPANZEES AREN’T TECHNICALLY “MONKEYS” ... but that really doesn’t matter here, since this one’s not even technically “infinitely typing” the complete works of Shakespeare! For one thing, he doesn’t seem to have enough typing paper within reach to do anything even close to that. (New York Zoological Society via Wikipedia / Public Domain)

… OH, BUT ONE LAST THING:

I did it again!!

I gave myself about a week (which is what you have to give when you publish “weekly” articles) to research and answer a question that’s been bugging me (and hopefully, many of you) to get it done by Wednesday, and I’m finding that doesn’t always work.

For one thing, important family matters sometimes come up (like they did this week), and sometimes it takes me longer than I thought to find the best information — I find it’s often buried deep! — and then to put it into words without screwing the meaning up too much. So:

First of all, please don’t look for an issue this coming Wednesday, as I’m skipping this week to try to catch up with some home stuff.

Second, please do get used to me doing that, as I occasionally find I need more than just the one week to adequately do justice to answering the question.

So while I will continue aiming for one issue each week, there are times I will fail miserably.

Thank you for your patience,

The Management